The SEC now allows small businesses to pursue faster crowdinvesting offerings because of (you guessed it) #COVID19

Raise Green enables project finance options for existing clean energy and community projects

May 10, 2020

On Monday, May 4th, 2020 the Securities and Exchange Commission (SEC) announced temporary, conditional relief for established smaller companies affected by COVID-19 that may look to meet their urgent funding needs through a Regulation Crowdfunding offering. The changes allow faster crowdinvesting offerings for some companies by providing relief from certain rules related to early offering closures and financial statement requirements. To use the temporary rules, a company must meet strict eligibility requirements and provide clear, prominent disclosure to investors about its reliance on the COVID-19 relief regulation amendments. The relief will apply only to offerings launched between May 4, 2020 and August 31, 2020.

In accordance with these SEC rule changes, Raise Green is offering owners of existing clean energy and community projects (that have Power Purchase Agreements or other contracted cash flows), to conduct expedited crowdinvesting offerings to raise debt or equity.

This is done in four key ways:

1) Existing projects and companies are eligible if they have a legal entity older than six months, and if they are not otherwise disqualified from issuing exempt securities under Regulation Crowdfunding.

2) Issuers can now start marketing their offering once an Offering Statement is available without the financial statement attached, to be followed by the financial statements that will allow investment commitments to be taken. For smaller offerings no more than $250,000, financial statements need only be certified by the principal executive officer (rather than a public accountant).

3) Offerings may now close sooner than 21 days if the target funding amount for the project is committed by investors.

4) The investment commitment cancellation period is changed from 48 hours before the close of an offering, to 48 hours after the investment commitment is made (barring any material change in the company or offering).

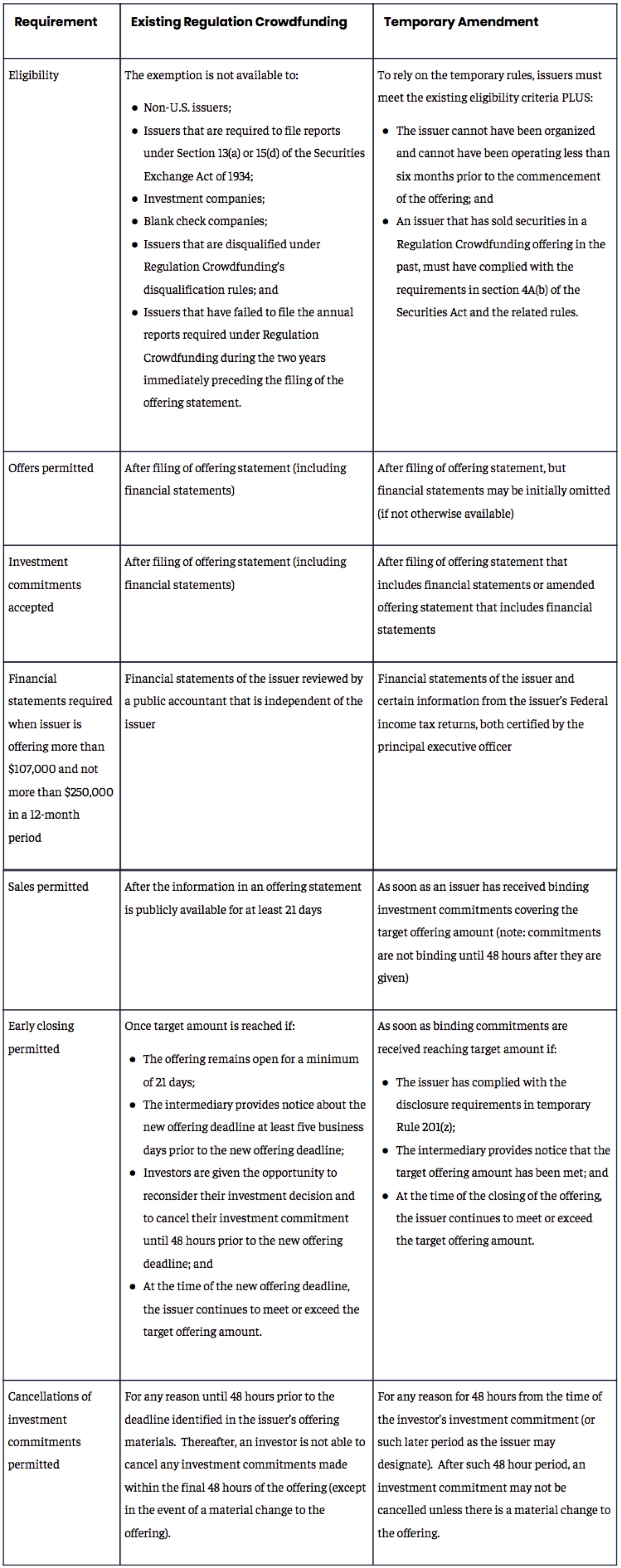

Please see the below Chart for a more complete listing of the changes.

All offerings using the temporary amendments must comply with disclosure requirements in the temporary SEC rule (Rule 201(z)). As the SEC said in the temporary rule: “The Commission recognizes that, in the current environment, many small businesses are facing challenges accessing urgently needed capital in a timely and cost-effective manner. A securities offering under Regulation Crowdfunding may be an attractive fundraising option for some small businesses at this time, particularly as a means of allowing an issuer to make use of the internet to reach out to its customers or members of its local community as potential investors as well as to existing investors.”

At Raise Green, we are intent on using our powers for good, just like all of the owners and (dreamers of being owners) of distributed clean energy projects and community businesses. There is an urgent need for capital in a “timely and cost-effective manner”. Raise Green enables anyone and everyone to participate in inclusive financing that is designed to benefit local small to medium businesses and community organizations. We encourage you to check the SEC’s press release about these changes, as well as the full temporary rule.

Please reach out to us at info@raisegreen.com if you are interested in raising funds on Raise Green or would like to learn more about what we do.

The following table summarizes the current rules and temporary amendments:

This Blog is for discussion purposes only, expresses the views of Raise Green, and is not investment research. This is not investment advice, and does not constitute a solicitation to sell or an offer to buy any securities. Certain information is from or links are to third party sources. Although they are believed to be reliable, we do not guarantee their accuracy, completeness or fairness. Raise Green is a licensed Funding Portal with the SEC and FINRA, and is not a Municipal Advisor. Prior to being approved to list a company on the Raise Green portal, a diligence review is completed. Prior to investing. investors must sign up for an account on the portal. Raise Green does not provide tax, accounting or legal advice. Investing in crowdfunded offerings involves risk and you should review the risks of a particular investment prior to investing. You are strongly encouraged to consult your professional advisors before investing. Go to www.raisegreen.com for additional information on services, the funding portal, regulation, and investment risks. Or, direct inquiries to info@raisegreen.com. Copyright © 2020

This Blog is for discussion purposes only, expresses the views of Raise Green, and is not investment research. This is not investment or tax advice, and does not constitute a solicitation to sell or an offer to buy any securities. Certain information is from or links are to third party sources. Although they are believed to be reliable, we do not guarantee their accuracy, completeness or fairness. Raise Green is a licensed Funding Portal with the SEC and FINRA, and is not a Municipal Advisor. Prior to being approved to list a company on the Raise Green portal, a diligence review is completed. Prior to investing. investors must sign up for an account on the portal. Raise Green does not provide tax, accounting or legal advice. Investing in crowdfunded offerings involves risk and you should review the risks of a particular investment prior to investing. You are strongly encouraged to consult your professional advisors before investing. Go to www.raisegreen.com for additional information on services, the funding portal, regulation, and investment risks. Or, direct inquiries to info@raisegreen.com. Copyright © 2021